Unlocking Career Success: How to become an Accounting and Payroll Administrator

November 28th, 2023

The one thing every business has in common is the need for careful financial management, including tasks such as bookkeeping, budgeting, and strategic financial planning. For businesses, the cooperation of accountants and payroll administrators is fundamental to maintaining financial stability. These professionals ensure accuracy, transparency, and compliance with financial regulations, forming the backbone of a company’s fiscal health. This article delves into the practical significance of both accountants and payroll administrators, explaining the vital roles they play in modern business operations. Join us as we lay down the ins and outs of how to become an accounting and payroll administrator.

An accountant is a professional who is responsible for preparing and examining financial records. They ensure that financial statements are accurate and that taxes are paid properly and on time.

What is An Accountant?

An accountant’s job is to keep and manage financial accounts, verifying accuracy, clarity, and compliance with relevant regulations. These tasks are essential to any business as they paint a picture of an organization’s financial well-being. Accountants may work in various settings, including public accounting firms, government agencies, or private corporations. Accountants go beyond crunching numbers and bring a wealth of knowledge to the decision-making table, helping organizations achieve financial efficacy and long-term success. The qualifications for becoming an accountant typically include a bachelor’s degree or diploma in accounting or a related field, with some roles requiring additional certifications such as the National Payroll Institute’s Payroll Compliance Professional (PCP) certification.

What Is Payroll Administration?

Payroll refers to the financial records of employees. When working as an accounting professional, payroll is often one of the most important responsibilities. It consists of managing and overseeing the process of paying employees within an organization. The primary duties include calculating wages, keeping track of deductions for taxes and benefits, and distributing paychecks or arranging direct deposits. Payroll administration is crucial for maintaining compliance with employment laws and regulations, staying updated on tax codes, and addressing any payroll-related questions or issues from employees.

A payroll administrator is responsible for ensuring that employees are paid accurately and on time, making it an essential function in any organization.

What Do Accountants Do?

Accounting mainly consists of three categories, which may be overseen by a single individual or different personnel, based on the size of the business. These areas include Accounting, Bookkeeping, and Payroll. All three are essential components of any enterprise’s financial health and stability. The tasks of each position are similar, but all serve a different purpose to the company. So, what are some of the main differences between these subsets?

Accounting: Accounting mainly refers to organizing, verifying, and presenting a business’ financial records in the form of different statements and reports. These documents are often presented to external stakeholders of the company and must be prepared in adherence to government standards and procedures such as the International Financial Reporting Standards (IFRS) and the Canadian Generally Accepted Accounting Principles (Canadian GAAP).

Bookkeeping: Bookkeeping refers to recording the day-to-day financial transactions of a business. It involves billing suppliers, documenting receipts, recording invoices, and monitoring the company’s accounts. Bookkeeping jobs are often done using essential software such as QuickBooks.

Payroll: As mentioned above, payroll is the management and distribution of employee salaries, bonuses, tax deductions and benefits. An accountant may be responsible for these tasks as well, but in larger companies, payroll administrators exist to handle anything to do with employees’ financial records.

Accountants perform a wide range of tasks, including preparing financial statements, examining financial records for accuracy, ensuring compliance with laws and regulations, and helping organizations run efficiently by providing financial advice.

Is Accounting a Good Career?

Accounting careers are practical and have their perks. They provide stability and a wide range of job options across different industries. Whether you work in public accounting, government, or private businesses, there are various paths to explore. The demand for accountants is expected to remain high with over 88,000 new job openings expected in Canada within the next seven years. Besides stability and job options, accounting offers opportunities for career growth. You can climb the career ladder by continually learning and developing your skills. Getting advanced certifications like the Certified Public Accountant (CPA) can open doors to higher-level roles. Businesses of all sizes recognize the importance of having skilled financial professionals to handle their economic matters.

How Much Do Accountants Make?

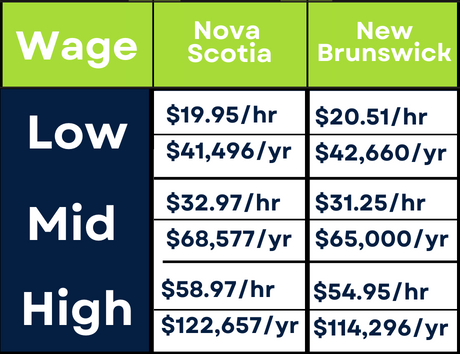

On top of the benefits mentioned above, accounting careers promise to be lucrative, with the national average starting wage being $23.00 an hour. The Job Bank of Canada reports the median accounting salary is an impressive $79,997 a year, while senior positions boast an average of $130,000 a year. A typical accounting salary in Nova Scotia or New Brunswick starts between $41,496 and $42,660 a year, reaching as high as $114,296 or $122,657 yearly.

How to Become an Accountant

- Education: The first step toward becoming an accountant is usually a bachelor’s degree or diploma in accounting or business administration. Bachelor’s and diploma programs in accounting provide students with the core skills and understanding required for beginning entry-level jobs or graduate study.

- Gain Practical Experience: Aspiring accountants can benefit from internships or entry-level positions, as it gives them a chance to gain practical experience and expand their professional network.

- Develop Skills: Master necessary skills such as attention to detail, analytical thinking, and improving your aptitude with accounting software. These competencies are necessary for success in the industry.

- Consider Certifications: While not always mandatory, obtaining professional certifications can enhance your credentials. The Certified Public Accountant (CPA) designation is one of the most recognized certifications for accountants.

- Networking: Establish connections with experts in the field, participate in industry events, and become a member of related professional organizations. Networking can lead to job chances and helpful knowledge.

- Stay Informed: Track changes in accounting guidelines, industry trends, and developments in technology. Ongoing learning guarantees you remain competitive in the field.

- Specialize if Desired: If your interests vary, you might opt to specialize in areas like tax accounting, forensic accounting, or management accounting to make your career path more personalized.

- Pursue Advanced Degrees (Optional): Some accountants choose to pursue advanced degrees such as a master’s or even a Ph.D. for roles in academia or specialized fields.

- Meet Licensing Requirements: If you are aiming to receive a specific designation, make sure you comply with the licensing prerequisites in your jurisdiction. This generally includes completing a certain number of work hours and passing exams.

- Apply for Positions: If you meet the educational and experience qualifications, you can begin to look for accounting jobs. Possible entry-level roles might include Accounts Clerk, Payroll Administrator, and Pay and Benefits Administrator.

The demand for professionals in accounting and payroll administration remains high across various industries. Every company, organization, small business, and even sole proprietors require individuals with accounting and payroll skills to manage their financial records and ensure compliance with regulations.

In conclusion, accounting and payroll administration offer rewarding career opportunities with enduring demand. Pursuing relevant courses, gaining practical experience, and staying updated with industry trends can pave the way for a successful career in this field. By taking the right steps, you can position yourself for a successful and fulfilling career in accounting and payroll administration.

If you’d like to know more about how you can stay informed and develop your skills, you can check out our Accounting and Payroll Administrator program at Eastern College.